The Great Financial Planner Cull Of 2020

While there’s been a lot of attention on FASEA’s recent release of their policies and legislative instruments, the focus for many financial planners has been on making sure they complete their higher education by January 2024. However, based on the current FASEA guidelines, they may be out of a job in 2020.

2020 is important because this is the year that existing advisers will need to sit FASEA’s Financial Adviser Examination. And based on the information provided to date, if you fail the exam three times, you’ll no longer be able to practice.To explain this comment, let’s look at the information FASEA has provided so far.

In their original consultation paper “FASEA-CP003 – Financial Adviser Examination” released earlier in 2018, FASEA laid out the framework for the financial adviser examination. Here’s what they said about the purpose of the exam:

The examination is an essential component of the educational qualifications and standards that all financial advisers are required by law to pass before they can provide personal financial advice to retail clients. The pass requirement is intended to ensure consistent, minimum professional standards of education and competency apply to financial advisers nationally.

The examination assesses applied knowledge, which forms a significant basis of competence in the profession. The examination is not the sole test of a practitioner’s competence to provide financial advice, however failing to pass the exam means that an individual cannot be authorised to provide personal financial advice to retail clients.

Did you get that? It’s not the sole test of your competence to provide financial advice, but fail it three times and you’re out! Sounds fair. Not!

To be fair, there are two ways you can read that announcement. This section could specifically be referring to the pathway a new adviser would have to take before they become a full adviser, but then it’d be totally ignoring the plight of existing advisers. And we know that existing advisers need to sit this exam. Alternatively, it could be referring to both types of advisers – new and existing – both of whom have to pass this exam.

When the concept of an exam was first announced, a lot of advisers worried about what topics it would cover. Would the insurance specialist be expected to sit the same exam as an SMSF adviser? And how would you structure such an exam?

FASEA gave some clarity and said the exam wouldn’t focus on financial planning strategy, but instead would cover these five areas:

- Corporations Act (emphasis on Chapter 7 – Financial services and markets)

- The FASEA Code of Ethics

- Behavioural Finance: Client and consumer behaviour, engagement and decision making

- Financial Advice Construction – suitability of advice aligned to different consumer groups

- Applied ethical and professional reasoning and communication

They indicated there would be 75 questions in the exam and 70 of these would be multiple choice and the other 5 would require written answers. They also said the exam would run between 3-4 hours and would be a face-to-face exam, meaning it’s not something you could sit in your office and do over the internet.

The plan was for existing advisers to be able to start sitting the exam from mid-2019 through to the end of 2020. It would be offered monthly in capital cities and less frequently in regional locations.

There would be no reference material brought into the exam, no phones and no internet. No pressure at all!

If you failed, you had the opportunity to resit the exam twice.

The majority of financial advisers haven’t studied for years, so apart from these five topics, you’d think FASEA would make it easier for them by providing them with some direction on what specifically they’ll need to study etc? Wrong. Here’s what they had to say earlier this year:

FASEA may publish a recommended reading list to guide candidates preparing for the examination on the FASEA website. The reading list is recommended but not mandatory and there are many publicly available resources that complement those in the list. FASEA does not intend to provide examination preparation courses. Candidates preparing for the examination should use their judgement about how to prepare and consult their supervisor in designing a plan of study based on the curriculum.

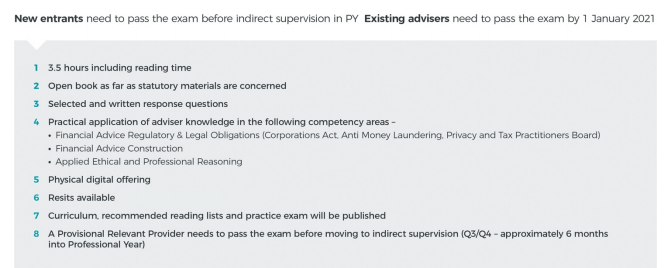

In November 2018 FASEA released further guidance with their Standards Summary. This document was essentially a summary of their thinking across a range of topics including the exam process. Throughout November and into December FASEA released further policies or legislative instruments on all the other topics except the financial adviser examination. The Standards Summary provides some clarification to the exam, and there are some noticeable changes, namely the reduction from five areas in the curriculum to three although when you look closely, the original five are still there, but just across three main groupings.

Here’s what they had to say:

The exam allows candidates to demonstrate professional reasoning and apply knowledge acquired to actual financial advice scenarios at AQF7 level. The curriculum will cover:

• Financial Advice Regulatory and Legal Obligations (including Corporations Act – Chapter 7, Anti-Money Laundering (AML), Privacy and Tax Practitioners Board (TPB))

• Financial Advice Construction – suitability of advice aligned to different consumer groups, incorporating consumer behaviour and decision making

• Applied ethical and professional reasoning and communication incorporating FASEA Code of Ethics and Code Monitoring Bodies.

The exam will be 3.5 hours including reading time and open book as far as statutory materials are concerned. The open book nature is a welcome relief for many planners. Also take note that they’ve specifically mentioned the exam being set at an AQF7 level. This makes sense if you’ve just completed an AQF7 degree and are a new adviser, but makes no sense if you’re an existing adviser who hasn’t studied for years and is now expected to sit an exam at AQF7 level.

FASEA also said that in addition to the previously announced recommended reading list, they’d also provide a curriculum and practice exam. Clearly, the lobbying and feedback they’ve received have been taken into account.

They also specified that a new financial planner (called a Provisional Relevant Provider) will need to complete the exam before they move into the second half of their professional year.

At the time of writing this article (mid-December 2018), there’s been no further policy document or legislative instrument released for the Financial Adviser Examination.

I’ve been talking with a few industry colleagues about this and I’ve asked them a number of questions about their understanding of the proposals.

One question I’ve asked is about the timing of the examination. If you’re a new adviser (commencing in 2019 or beyond) you only need to complete the exam before starting the second half of your professional year. To be eligible to start your professional year you will need to have completed either an approved degree (AQF7 level), your Graduate Diploma in Financial Planning (AQF8) or an associated qualification. So a new adviser would have completed their studies and be well acquainted with the academic world of study, assignments and exams before they need to sit this exam.

If you’re an existing adviser, it’s different. At the moment, there’s still no clarity around which courses will be approved by FASEA. As I understand things, currently no educational institution can offer a FASEA-approved Graduate Diploma in Financial Planning because they are unsure of the required content. So, understandably, many planners are deferring their studies until they can be sure they’re not wasting their time with a course that may or may not be approved. If these delays continue, then potentially an adviser would have the opportunity to sit the Financial Adviser Examination without having commenced any further study. If you haven’t studied for a number of years and are then expected to sit a 3.5-hour exam, wouldn’t it be better if you had a couple of units of study (and exams) under your belt and the confidence that comes from knowing that you’re back in the studying groove?

So the timing issue remains. In their original consultation paper, talking about the purpose of the exam, FASEA said: “The examination assesses applied knowledge, which forms a significant basis of competence in the profession.” By making existing planners sit the exam before they complete their studies and potentially before they even start those studies, what knowledge is FASEA seeking to assess? They also say “The pass requirement is intended to ensure consistent, minimum professional standards of education and competency apply to financial advisers nationally.” How does that work when you’re asking people to sit an exam before they’ve had a chance to complete the minimum professional standards of education.

Wouldn’t it make more sense to get advisers to sit the exam once they’ve completed their further studies but before the January 2024 deadline?

And what about advisers who are intending to retire before 2024? What’s the point of them completing the exam?

Another question I’ve asked is around the need for the exam. I know it sounds like a good idea and, as I understand things, an exam was one of the requirements the government made when FASEA was first set up. But if an adviser completes an AQF8 level Graduate Diploma, doesn’t that show that they have a high level of competence? If that same Graduate Diploma included topics on their regulatory and legal obligations, financial advice construction and ethics, AND they’ve completed exams and assessments on those areas, what extra is the exam assessing?

And, back to my earlier point, if these things will be covered in their further studies, isn’t it unfair to assess them on their current understanding of these areas rather than waiting until they complete their studies?

And is it also unfair that a new entrant gets to complete their studies and then sits the exam whereas an existing adviser has to complete it by the end of 2020 without the benefit of studying these areas?

Another question I’ve asked is around the implications of failing. The people I’ve spoken with all agree that the way the guidance is currently structured if a planner fails three attempts, they can no longer practice as a financial planner. A couple of colleagues have spoken with members of parliament about this and the feedback they’ve received is that this was not intentional and they’d raise it with FASEA to seek alternative solutions. However I’ve also heard anecdotal evidence that some people have suggested this wording is intentional and the intent here is to remove financial planners from the industry if they can’t pass the exam, hence the title of this article – The Great Financial Planner Cull of 2020.

It’s important to clarify what happens if you fail the exam three times. What I’ve been told is that the only option for you to return to the industry will be to be treated as a new adviser. The problem is that by the end of 2020 you probably won’t have finished your Graduate Diploma so you won’t have sufficient qualifications to enable you to start again. You can’t re-enter the industry if you don’t have appropriate qualifications, because post-2018, RG146 is irrelevant. And if you can’t work as a planner, your licensee can’t pay you revenue. And if you can’t service your clients, all ongoing fees will need to be turned off. What does that do to the value of your financial planning business?

Most planners I speak with haven’t even contemplated the possibility of not being able to work as a financial planner post-2020. And whilst many are positive about further study, I have concerns about the ability many of them will have to pass an important exam when they’ve been outside the academic world for years.

What about if you only fail part of the exam? The original document talked about a 75% pass rate for the ethics component and 50% pass rate for the other topics. If you only failed the ethics part and passed the others, are you able to just re-sit the Ethics part of the exam or do you need to re-sit the whole exam? I know planners who have failed a topic in one of their Advanced Diploma topics and have to re-sit the portion of the exam that covers the area they failed. They are very nervous leading up to that exam. It’s soul destroying and saps your confidence if you fail an exam like this. Now take that pressure and add to it the risk that if you fail three times you’re out and begin to try and imagine the pressure many planners (who are already stressed by things like the education changes and the Royal Commission) may feel. It’s not pretty.

A lot of this has flown under the radar for many financial planners. Their focus has been on the conversation around further study and what recognition they’ll receive for their prior study. And for many, it’s just been easier to not think about the future changes. It’s less stressful if you ignore them.

Some people will suggest that I’m being over the top in my observations on this topic, but all I can do is analyse the brief announcements that FASEA has made. I’m looking forward to the imminent release of the policy paper on the Financial Adviser Examination and I hope it answers the questions that I have and provides more flexibility for existing financial planners, especially those who fail the exam. But if the questions around what happens if you fail three times aren’t answered, financial planners around Australia should sit up and take notice.

And regardless of whether the three strikes and you’re out policy remains or goes, a more important question is why was it ever included in the first place?

And I’m still waiting for someone to explain why it’s necessary for this exam to be completed by the end of 2020 for existing advisers. If it’s to test your competency at an AQF7 level, then make them sit the exam when they complete their further studies and before 2024. As it stands now, I’m inclined to believe that one reason this exam exists is to reduce the number of existing planners by removing from the industry those who fail the exam three times. It’s not a pretty thought, but I can’t see too many other reasons for this exam.

Financial planners and industry colleagues, I’m interested in your thoughts here. Are you concerned about a three-strikes-and-you’re-out policy? Are you satisfied that there’s enough information available to give you a high probability to pass? Had you thought about what would happen if you didn’t pass the exam?

Leave a comment and let me know your thoughts.

0 Comments