Financial Planning and One Day Cricket – How To Plan for Retirement Using A Cricket Analogy

Most financial planners I know struggle to explain retirement planning concepts to their clients. But there’s an easy way to do it and it involves the game of cricket. Intrigued? Read on.

Most financial planners I know struggle to explain retirement planning concepts to their clients. But there’s an easy way to do it and it involves the game of cricket. Intrigued? Read on.

This past summer I went to a few BBL cricket games (sorry to all the cricket purists who only like games that go for five days, not five hours).

Going to the cricket reminded me of a financial planning concept that has a lot in common with the Big Bash.

It’s all about their goals

There’s been a lot of discussion about goals-based financial planning over the past few months, with a couple of licensees making announcements that would lead you to believe it’s a brand new idea as opposed to something that financial planners should have been doing for the past thirty years. All this is a good thing because it gets us talking about the things our potential clients actually need and value, and gets the conversation going around how we deliver them.

At it’s simplest, goals-based financial planning is this : You’re at point A and want to get to point B. What do you need to do (save) to get there? Or, you’re currently 40 years old and want to retire at age 60 on an income of $100k a year. What do you need to do to get there?

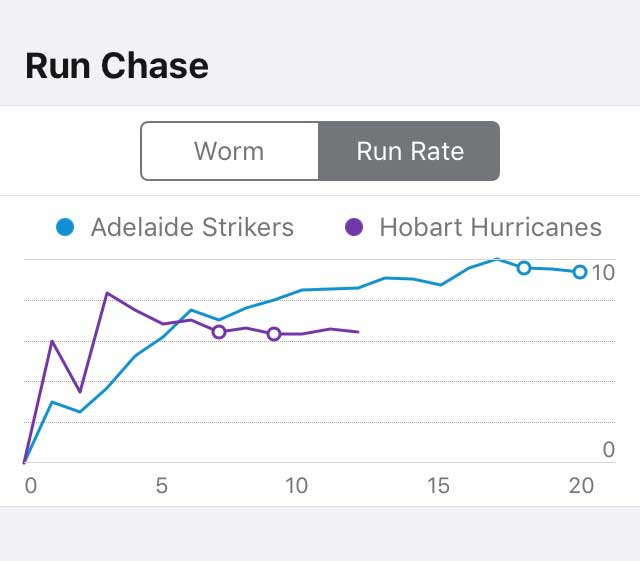

What’s your required run rate?

And this is where the BBL (or cricket) comes in.

Pretend your client is the team batting second.

The total that the other team made is the goal. In money terms, it’s the lump sum the client needs to achieve in order to retire comfortably.

At the start of your innings, you have a required run rate. In cricket terms, this is the amount you need to score each over in order to achieve your target. For your clients, this is derived from two things:

- the amount they need to save every year (based on average rates of return) in order to achieve their retirement lump sum.

- A reasonable expectation of growth on their existing capital.

You may calculate that the client needs to save a total of $30,000 per year in order to achieve their desired lump sum of capital on their retirement date. This contribution, along with the estimated growth on their portfolio will give them a high degree of certainty around achieving their desired lump sum.

Using financial planning software (or even a basic spreadsheet) you can plot this on a graph and show them where you expect their capital to be every year leading up to retirement.

The innings commences

In cricket, after the first over is bowled we review everything and the required run rate is recalculated. If you needed to score 9 an over and only scored 5, it will increase. If you scored 18, it will decrease.

After a year of saving for retirement, you’d have a review with a client and help them understand how they’re tracking towards their required run rate. Did they save what they needed to and did they get the returns they needed? Are they where you thought they’d be on that graph or are they behind or in front?

Let’s say they experienced poor investment returns and are lagging behind the required run rate line. What can they do? In cricket, there’s only one option – hit more runs. In financial planning, they have a few options. The financial equivalent of more runs is to save more to top up the difference. Alternatively, they could seek higher returns either by taking on more risk or opt to continue their current strategy with the view that markets will recover.

And just like the BBL, there’s no need to panic after just one over if your run rate is behind where it needs to be. You’ve got another 19 overs to go, just like the (now) forty-one-year-old client who wants to retire at sixty.

Also, I’m very conscious that a one-year period is too short a time to make any knee-jerk decisions about investment performance. So, in reality, you wouldn’t get too excited or disappointed after one year. In fact, you’ve probably had a conversation with the clients at the start of the journey about how investment returns are variable and they’ll never actually achieve the projected return in any one year – they’ll be above it some years and below it in others.

Reviewing progress

After five years, you’ve probably experienced some good overs (years) and some bad ones. That’s a good place to have some meaningful conversations with the client about how they’re tracking.

Maybe they’re ahead of plan and have more saved than the plan said they would at this point in time. Great. They could decide to lower their contributions, maybe change asset allocation or even bring their expected retirement date forward by a year or two. Or they could use that as a buffer and keep going at the same rate with the intention of being further ahead in a few year’s time.

In the BBL some setbacks can occur – you can lose a wicket. It can then take the new batsman a few overs to get settled in and the run rate can suffer during this period. This sounds a lot like a market downturn.

But if you lose a wicket early on, and your run rate is already ahead of plan, there’s less pressure to change than if you were later in the innings and behind where you needed to be.

Your clients would panic less during a market downturn if they understood the impact on their long-term retirement plans. If they knew where they were on the run rate graph, they could put the downturn in perspective. If they were already ahead of plan and now with a reduction in capital they’re back to where the plan thought they’d be at this point there’s less to worry about.

They’ll still be uncomfortable with the downturn – that’s basic investor psychology. But they can now frame the downturn differently when they understand the impact on their financial plan.

If it puts them behind the plan, then at least they know where they are and can look at ways to get back on track.

To me, this concept of retirement savings being like the required run rate in cricket is a simple example, and easy for your clients to understand.

The problem is how you produce reports to show clients how they’re tracking. Unfortunately, most financial planning software is built to assist with initial recommendations and struggles with the concept of tracking progress towards goals.

This also helps you provide exceptional value to your clients at review time. A review is no longer about their investment performance, but about the big picture and things they (and you) can control and influence. Clients will be keen to meet with you for an annual review because it’ll mean something to them – they’ll want to see where they sit on the graph.

This motivates people to take action. Why? Because it makes the financial planning process tangible. It’s no longer about a superannuation fund – you’ve set out a plan that they can follow and you’re showing them how to adjust that plan based on the events that will occur along the way.

Action Steps:

Can you use this example with clients?

Are you comfortable working out the required run rate?

How will you provide reporting towards goals?

0 Comments