The Ansoff Matrix and the Financial Planning Business

One of the most popular articles I’ve written was about the Ansoff Matrix.

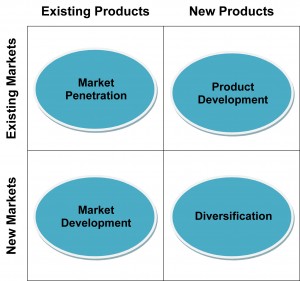

The Ansoff Matrix is a tool a business can use to help come up with innovative ways to grow. It’s divided into four quadrants and looks at the options of selling new or existing products to new or existing markets. Have a read of my original article to get an understanding of it.

The Ansoff Matrix is a tool a business can use to help come up with innovative ways to grow. It’s divided into four quadrants and looks at the options of selling new or existing products to new or existing markets. Have a read of my original article to get an understanding of it.

I was recently working with a local financial planning business and we used the Ansoff matrix to come up with some ideas they could use to grow their business. In today’s article I’ll share some of those ideas.

Market Penetration

This particular business had focused on people aged 50 – 65. The products it sold ranged from managed funds (mutual funds) to retirement savings products to insurance. When we examined the client base we determined that many of the clients were unaware of the range of products the business provided. Some clients only had one product when they were prime candidates to have more. A huge opportunity existed for that business to meet with existing clients and see if any of the additional products were appropriate for them.

You can see from this that the market penetration strategy could be the least risky for this business. It involves meeting with existing clients who they already have a strong relationship with and suggesting things that could also help them.

Market Development

We then looked at the option of finding new markets for their existing range of products. This may be appropriate for some businesses. This business had two options – new markets could mean opening an additional office in another city – they decided against this option because it didn’t fit their vision. They did decide however to begin to offer their services to a younger age group – the 30 – 50 demographic. Many of their existing clients have children in this category so the business thought it would be a relatively simple process to begin offering advice to the children of their clients. This also fits well with their vision of helping clients generate inter-generational wealth for their families.

Product Development

This was perhaps the most challenging area we discussed. Whilst the business understood that there was still a lot of potential to sell more of it’s existing product range, it also acknowledged that there could be opportunities to introduce additional products. The firm is now in the process of surveying its clients to find out what they want.

A couple of options we’ve already discussed include introducing a new fee-based review service that provides a range of additional benefits to the client. We’ve also discussed providing lending services to help clients with home loans etc.

Diversification

Considered the most risky of the four strategies, diversification involves selling new products to new markets. The firms acknowledges that if it introduces new services in the product development quadrant, it has an opportunity to market and promote those services to people who would not normally have considered their firm.

For example, someone wanting a home loan could approach them for advice, and in the process they’d also be able to offer some of their traditional financial planning products to that person (market development).

How does it help you?

The Ansoff Matrix has enormous potential to help you grow your business. You may not run a financial planning business – it doesn’t matter. The point of this article is not to give you ideas to grow a financial planning business but to make you stop and think about the product or service you sell.

- Are their ways to sell more to your existing clients?

- What new markets can you aim at?

- Are there new products you can invent that you can offer to your clients and prospects?

Take time today to think about these questions. Let me know some of the ideas you come up with.

0 Comments

Trackbacks/Pingbacks