Technology for Financial Planners

Making life easier for you to provide advice

Technology is changing the way we do business and is impacting on every aspect of our lives.

Smart financial planners are using technology to provide efficiencies in their business, so they can provide financial planning advice in a more timely and cost-effective manner.

And technology isn’t just about what financial planning software you use. In many cases, you’ll have no choice about that, as it’s something your licensee will mandate.

It also includes things like the programs you use to collect data, write financial plans, communicate with clients, manage tasks, keep track of your business performance and how you keep in touch with your staff.

Confession time. I’m a bit of a geek. I’ve always been interested in technology. As a kid playing the guitar I would read about the latest guitars and effects and the sorts of sounds you could create. I can’t believe that today my home studio has more recording power than The Beatles ever had. Yet I’m not producing Beatles-quality songs.

In the financial advice world, I’ve watched the rise and fall of Visiplan and the current dominance of XPlan as the financial planning software of choice.

In recent years I’ve watched as the fintech sector has grown and with it brought the promise of more efficiencies and a better way of providing advice.

I’ve seen how social media and online advertising has changed the way we communicate and make purchasing decisions.

I’ve also been disappointed at how slow some areas of our industry have been to explore the use of technology. Most of us are still using a paper-based fact find!

I’m on a mission to find the best bits of technology that financial planners can use in their business.

What does your Technology Stack look like?

You probably use XPlan for your financial planning software, but what else do you use?

Do you use Microsoft’s Office suite of products, or do you use Google Docs?

What accounting software do you use for your business? How do you track your revenue? Your pipeline?

Do you use Trello to track tasks and see how your team are going?

Every business is different. We can help recommend tools that will help your business run more efficiently.

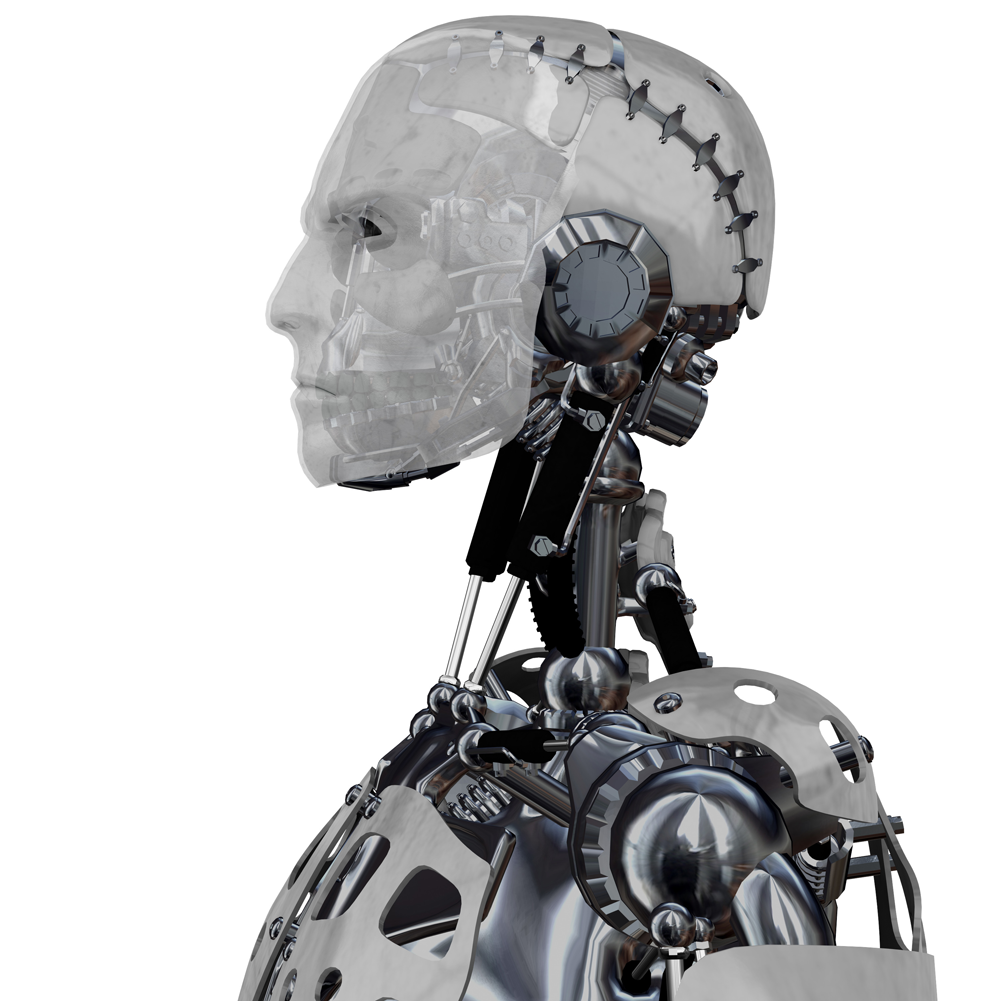

Artificial Intelligence (AI) and Machine Learning are having a massive impact on our industry.

Whilst many are scared of robo-advice, I believe it goes hand-in-hand with what a financial planner does.

Think of it like this. A doctor can use technology to diagnose a patient’s condition a lot quicker than they can do it themselves. The technology can also recommend the optimal way to treat the patient. The doctor’s job is to be the person who provides the human touch and the relationship with the client. This is no different to how financial planners can use technology to help their clients achieve their financial goals.

I love learning about how AI and machine learning are improving the quality of financial planning advice.

I’m ready when you are! Get in touch and let’s start working on your business.