Is Your Financial Planning Business a Netflix Or a Blockbuster?

Netflix recently released its latest results and says it’s added a record 7.05 million new users in the fourth quarter. 5.12 million of these were from international markets.

Netflix recently released its latest results and says it’s added a record 7.05 million new users in the fourth quarter. 5.12 million of these were from international markets.

Part of the growth is due to international expansion, part is from having good content – programs that people want to watch (Gilmore Girls, anyone?).

At my local shopping centre is a DVD rental store. I know, it’s 2017 and that’s crazy but this store still exists. What’s even more crazy is that it actually changed hands a couple of years ago – why anyone would buy a bricks and mortar video store is beyond me.

I used to enjoy heading to the video shop to rent videos. And by ‘video’ I mean actual videos – the VHS variety. The ones that you had to rewind when you finished watching them.

More recently (as in the past ten years) I’d rent DVDs (no rewinding required).

So why is the traditional video store dead (or at least on life support) but Netflix and other streaming services are thriving?

Because they were in the wrong business.

The problem with video stores holding a physical product was the need for inventory. If you didn’t have the latest movie to rent, you missed out on business. And you needed multiple copies of the movie to keep your customers happy.

But when that movie declined in popularity, you probably needed to hold less copies of it.

If I came into your store looking for a particular movie and you’d already run out of copies, I’d go somewhere else and rent it.

The video store owner was hampered by the need to hold physical copies of movies. And there was little point in holding any obscure movies in stock, because they’d hardly ever be rented.

But now we watch a lot of video online, via streaming.

We no longer need to hold a physical copy of the program we want to watch. We download it and watch it.

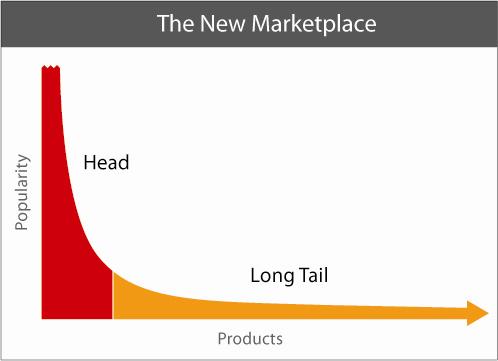

Chris Anderson, in his book The Long Tail explains that when there’s digital delivery and no physical inventory, an online store (like Netflix or an Apple Music) can hold a much wider range of movies. It can afford to offer some of the obscure movies because all they are is some data on a hard drive, not physical space on a shelf.

So the popular movies are still popular and streamed the most, but there’s a long tail of less popular titles that have a much smaller audience.

The video stores failed to adapt to the digital change. It’s easy to see in hindsight, but perhaps it wasn’t so obvious to them at the time. Why didn’t Blockbuster create Netflix? It had relationships with all the major movie distributors but stayed focussed on its model of renting physical copies of movies instead of seeing the shift to digital.

Netflix started as a mail order DVD rental business. And Reed Hastings (the owner) offered to sell 49% of Netflix to Blockbuster to they could get into the online video rental space. They turned him down.

Netflix then moved into streaming movies and started to create its own content – something Amazon Prime is also doing. House Of Cards was Netflix’s first production and won three Emmy Awards.

The important thing to understand here is that the end result of what these two businesses – Netflix and Blockbuster – sold is exactly the same – I sit in my lounge room and watch a movie or TV series on my television.

The difference is in the delivery. With Blockbuster I went to them and borrowed a physical item, with Netflix I don’t need to go anywhere. I just sit on my couch, select a movie and start watching. Actually, with our internet connection it’s more like select a movie, make a cup of tea while it starts downloading, then start watching.

My concern is that the financial planning industry will undergo a Netflix-type change, and many planners will realise too late that they’re still running a Blockbuster.

So what can you do about it?

You must understand what the consumer wants. Notice I didn’t say ‘understand what your product is’? The consumer doesn’t want your product, they want the outcome.

I never wanted a VHS cassette. I wanted to watch a movie.

What do your clients want? What are the outcomes that good financial planning provides to them? When I’ve looked at surveys asking these sorts of questions, answers such as ‘peace of mind’, ‘knowing I’m on track to retire when I want to’, ‘knowing where my money is going’ and ‘having confidence that my money is working for me’ are some of the responses.

Notice they didn’t say ‘having the best superannuation fund’ or ‘the best insurance policy’.

Blockbuster thought they were in the DVD rental business. They weren’t. They were in the business of helping their customers watch movies. The product they sold (DVDs) was what enabled their customers to watch movies.

I speak with a lot of financial planners and it’s interesting to hear the different responses around what they do that creates value for their clients.

Some are like Blockbuster and think that their value proposition revolves around a product.

Some say they’re like a Netflix and have a value proposition based around outcomes, but their charging models show that they’re in fact still like a Blockbuster – getting remunerated for product advice.

My fear is that the industry is still in a Blockbuster-like state and is not prepared for the potential disruptions that will inevitably occur.

If I took a quick poll amongst my readers, I’m sure that the majority of you use at least one of the streaming services – Netflix, Amazon Prime etc for movies or Spotify and Apple Music for music. Even YouTube can be classed as a streaming site.

You probably didn’t use them five years ago, but you do now. And I bet you enjoy the programming selection and the ease with which you can watch something.

No-one is longing for the good old days when you had to hop in the car to get to the local video rental store.

Over the next five years, the financial planning versions of Netflix will come into this industry and create change and disruption. They’ll use technology to build a better advice process and they’ll innovate by trying new things that meet the customer’s needs.

Forget waiting two weeks for a Statement of Advice – it’ll become instant.

And face-to-face engagement with clients in your office during business hours – that model will change as well. And yes, I agree that face-to-face contact is important in building strong relationships with clients, but I also think that an alternative like video-conferencing will be incredibly attractive and convenient to clients who want advice at a time and location that suits them.

Don’t say that it won’t happen or can’t happen to the financial planning industry. It can and it will. Why is it that we embrace technological change in so many areas of our life but choose to believe these sorts of changes won’t occur in our industry?

So, is your business a Blockbuster or a Netflix?

Businesses that truly understand what their clients want and can deliver those services in a way that the client sees as being valuable will succeed.

Financial planning businesses that continue to promote a value proposition that’s based around a product will struggle. That’s because your product will become like a VHS movie.

The biggest challenge that I see is this – in areas where there’s been massive disruption, the disrupters have usually come from outside the industry. Just think about Uber, AirBNB, Amazon, Netflix etc. These businesses disrupted existing industries by innovating and offering a better product.

And this can happen in the financial planning industry. We’re all focussed on what the current players are producing in but we’re not thinking about what a new entrant could do. What if one of the major retailers here in Australia or even globally started selling financial products and offering advice? Coles and Woolworths do it to a degree with their credit cards and insurance, but what if they got very serious and invested a lot of money into finding a better way for Australians to save for their future and protect themselves?

What if Amazon decided it wanted to offer financial planning?

Bottom line – it’s tough to predict what’s going to happen. Hindsight is great but it’s hard to predict something when you don’t know what it’ll look like.

To combat all this you need to have a strong idea around how you can create value for your clients. You need to think afresh about your business and the way it’s structured. Are you offering all the services that your target market are looking for? Have you taken advantage of the latest technology to be able to deliver efficiencies for your business and clients?

What do you think? Will the financial planning industry undergo a Netflix-like change, or is the Blockbuster model still a safe option? Leave a comment below.

0 Comments