Dear Financial Planning Industry. It’s 2015, Not 2005

The financial planning industry here in Australia has been through a lot of change over the past year.

We’ve had the changes to opt-in, various reviews and ideas for reform around life insurance, discussions around education requirements and a lot of talk about robo-advice.

And I observe many product providers and licensees saying the right things about the future of advice. Unfortunately their systems and process are more at home in the world of 2005, not 2015.

Over 2015 I’ve been frustrated by some of the systems and programs I’ve been using and the lack of common sense that exists in our industry. Here are some examples of the things that have annoyed me over the year.

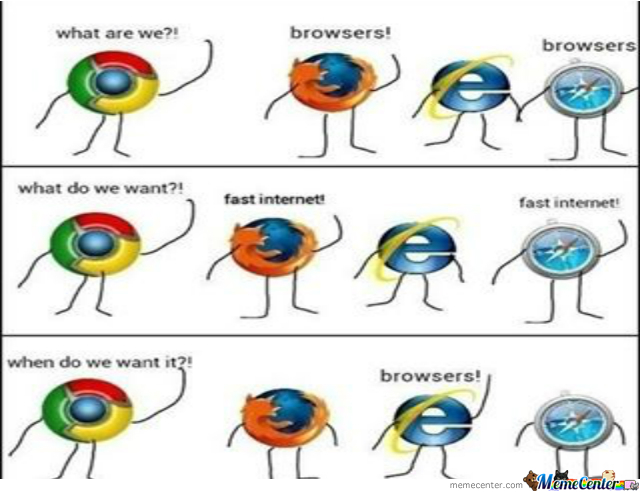

Into the Internet Explorer Twilight Zone

One of the major platforms has a web portal that allows me to see all my client information and transact on behalf of the client. The problem…it only runs on Microsoft’s Internet Explorer.

Now I don’t know about you, but I stopped using Internet Explorer a few years ago. Probably around the same time they stopped making PCs with floppy disk drives and Windows released a horrible thing called Vista.

The frustrating thing about this particular site is that it detects what browser I’m using and if it’s not IE, it won’t even let me login to the site.

On the subject of browser compatibility, there’s at least one insurer I can think about who has an online quoting system that doesn’t play well with other browsers.

You can start off doing an insurance quote, but then fields don’t line up like they should and some don’t even display on the page properly, making it impossible to finish some quotes and not realise why.

Again, I’m really glad they have an online quoting (and application) process, but that is the sort of thing I expected five years ago. I would have thought by now they’d ironed out some of the bugs.

Now, back in 2005, most people used Internet Explorer (and a few geeks used Netscape Navigator). But it’s 2015 and there are different browser options – Safari, Chrome and Firefox the most popular – that people use. So why can’t these financial services companies get their act together and release systems that work across all browsers.

Here’s the thing. If I have a poor experience with your web site or quoting software it makes me wonder what else isn’t great about your company or product.

When you sell a service the user looks for things that make the service more tangible.

For many companies their website is one of the first interactions people have with their brand and if their quoting software still thinks its 2005 and wants me to use Internet Explorer, it makes me doubt that this company has the ability to deliver anything innovative.

Error, What Error?

This morning I had an experience with another insurer’s quoting system. They shall remain nameless, but I do want to thank them for inspiring this article.

I was working on a quote with some different policies that were linked via super. However I hadn’t set up the linking properly and one of the policies was highlighted as having an error. The message said to click on the policy to open its tab and correct the error. The problem was that when I opened the tab, there was no obvious error. I would have thought you could highlight the error in red so it’s obvious to the user. Not so.

So instead I wasted time trying to link and un-link the different policies so the quote could actually work. And as I was doing this I wondered how a quoting system like this that wasn’t very user friendly was ever released for advisor use.

Free tip for software providers – test your programs thoroughly before you release them to the public, and then have a system to obtain feedback easily.

It’s a mobile world

I’ve looked at a lot of advisor websites over the past year and a very popular option is to use the default option that a licensee provides.

I’ve said before that these starter websites are better than no website at all, but eventually you’ll outgrow them if you want to do any serious internet marketing for your financial planning business.

One of the big problems with these sites is that usually they’re not mobile friendly. When you view these sites on a mobile device, you see the whole website condensed into very small type across your mobile device’s browser.

Earlier this year, Google said that it would penalise sites that weren’t mobile friendly. These sites will no longer show up in any searches performed on a mobile device.

So how does your site stack up? The simplest thing is to open your site on your smartphone and look at how it displays. If it’s not mobile friendly, you have a problem (that I can help fix).

I find it ironic that many of these licensees are encouraging advisers to embrace the internet, yet they haven’t upgraded the system their adviser’s sites sit on to make them mobile friendly.

It’s simply not a priority.

Numbers Game

I changed licensees at the beginning of the year. For those readers who have done this you’ll know that it can be a fun experience trying to get clients transferred across from each fund manager / insurer and setting up new advisor numbers.

One platform provider sent me an email with my new adviser number and told me their customer service team would be in touch soon with details of my online access codes.

A few weeks later we wanted to login to their website (using Internet Explorer) and realised we’d never been sent a login code. We called the helpdesk and were told that we had to apply for a code, they weren’t automatically provided. When we pointed out they’d actually sent us an email saying they’d issue us with a login, we were told that was a templated email and wasn’t correct.

No, I’m not making this up.

It’s 2015 and every adviser I know uses a computer daily. If you were a product provider wouldn’t you automatically give advisers online access to their clients rather than making them apply for it? Particularly because I had online access with my old adviser code. And if your template was incorrect, wouldn’t you fix it?

We’re Innovative Because We Say We Are

Last week I was looking at the websites of a number of ‘fin-tech’ companies in Australia.

These are companies that say they’re at the forefront of online technology for the financial services industry.

But one of them had a website that wasn’t mobile responsive, so the entire site condensed across the top of my screen and I had to pinch and expand the text to be able to read it on my smartphone.

Really? They’re targeting the financial services industry and talking about the benefits of mobile technology, yet their own site doesn’t display properly on my phone.

And I won’t mention the other company that had a copyright date on the footer of its site that said © 2013. Nice to see you’re current.

You Can’t Post That…Yet

Social media is becoming popular amongst financial planners and 2015 was the year that I saw many advisers take the plunge and start using Facebook and LinkedIn.

Yet licensees still fail to understand the differences between social media and websites.

I’ve dealt with a few different licensees on behalf of some of my advisor clients and it’s been an interesting experience.

I had one licensee insist that a general advice warning should be added to every post. When I pointed out that Twitter only allows 140 characters and the disclaimer itself was more than 140 words I was met with silence.

Another said that everything posted to a planner’s Facebook page had to be approved. But the approval would take up to one week. So if we wanted to post an article from a news site about the day’s interest rate decision from the Reserve Bank, we had to email the link and text we wanted to use to the compliance department and they’d take up to a week to approve the post. And they thought the post still needed a disclaimer because apparently people can’t figure out that a post to a news site isn’t comprehensive financial advice.

Another planner had a lot of articles on their website that they’d written over a few years. They wanted to post links to these (previously approved) articles on their Facebook page. Their licensee insisted that they still needed to send every article and complete text of what we were going to say in the Facebook post before they’d approve it.

Can We Raise The Bar?

I’d love to be part of an industry that uses technology to help us provide advice that’s accurate and affordable for our clients.

But we’re just not there yet.

And I think part of the problem is that a lot of the incumbents are stuck in ‘financial services world’ and don’t look outside their box to see how other industries are using technology.

- Can we look at best practice in other industries and apply those concepts to the financial planning environment?

- Can we get serious about online applications and data collection tools that are interactive and fun to complete, rather than a chore?

- Can we look at gamification and work out ways to engage people so they’re more interested in their money and saving for their future?

- Can we accept that an online quoting system is no longer something special – everyone has one now? Perhaps you could work out a way to improve yours?

- Can the compliance and technology people work together (and perhaps add some common sense) so the consumer benefits from the efficiencies that technology can bring?

- Can we as financial planners stop saying that robo-advice is a threat and instead see it for what it is – a natural progression in applying technology to an industry?

Anyway, 2016 is a new year and I’m excited about helping advisors use technology to attract new clients.

I’m also excited about the potential benefits that technology will continue to bring to this industry in 2016.

And I’m cynical enough to know at this time next year, I’ll be able to write a similar article to this one!

What are your thoughts and stories on technology in the advice industry? Who’s doing it well and who needs to do it better?

0 Comments